2nd Bac Socialism and Free Enterprise

Socialism and Free Enterprise

https://www.youtube.com/watch?v=7NRnOpLpwyY&ab_channel=PolicyEd

https://www.youtube.com/watch?v=4opFbB6okwo&ab_channel=EvanThomas

According to an old joke that has made the rounds of Eastern Europe, the basis of capitalism is the exploitation of man by man, while with socialism the situation is just the opposite. We shall study socialism and free-market competition not as political systems but as different economic principles. As we have indicated, we hope to show that if we study these two principles in their pure forms, their logic will correspond to the rationality of the group selection and gene selection theories rather precisely. At present, there is vigorous debate over which theory correctly describes how evolution operates. No intermediate solution has been forthcoming within the frameworks of these theories, and in the previous chapter we considered that the two theories might indeed be valid simultaneously. We can observe in economics how analogous principles can coexist. There was a time when the virtues of free-market capitalism and socialism were fiercely debated. Today, however, neither capitalism based on free competition nor socialism in the sense of Marx can be said to exist, at least in their pure forms. Both principles have been tried and been found unfit. Systems that have proved to be more or less fit have arisen from combinations of these two principles. Economists call them mixed economies. History has provided large-scale experiments with pure capitalism and pure socialism, often ending tragically, which happened to prove that these systems are unsuccessful in the long run. These experiments were not conducted by economists, but by societies, but economists had the opportunity to observe the experiments and even to influence them slightly. Biologists cannot make such observations, since evolution as a natural force is as it is, and it is not in the power even of politicians to test what the world would be like if evolution worked differently. Therefore, the large-scale political experiments in which different economic systems have been tried can be of use to biologists who study evolution. On the other hand, biologists can conduct experiments that are unavailable to economists. They can observe organisms under artificial circumstances-just as Milinski did with his sticklebacks. Economists are precluded from performing such experiments because they would be ethically unacceptable. All branches of science are sometimes faced with methodological gaps. In such cases, it is usually preferable to close the gap by analogy with a similar scientific discipline than to enter into random speculation. Such an analogy must, of course, make sense, and in our case, we must ask whether a force analogous to evolution is manifested in economic systems.

Economics and Evolution

If natural selection-the struggle for survival-is the principal mechanism of evolution, it should not be difficult to find analogies in economics. In nature, participants in evolution's Olympics compete for natural resources, while in the economic sphere, the battle is more literally for the gold. This difference might be fatal to our analogy, since, for example, customers sought by competing firms are capable of making conscious, reasoned decisions, while natural resources cannot. This difference will be accounted for in our models, but as we shall see, it does not affect their logical structures significantly. In the case of participants in biological evolution, there is an obvious one-dimensional measure that indicates the fitness of an individual (or gene, or group): the number of offspring who survive to re-produce. This measure is computed differently according to the particular theory of evolution. Thus the selfish gene theory prefers to measure not the number of offspring, but the number of genes that are passed to the next generation. Nevertheless, each theory justly assumes that selection has a well-defined measure at its disposal, a measure that it "wants" to maximize. In economics, however, there is no such clear measure. Although the basic principle is to maximize profit, many other factors may intervene, from social sensitivity to the impudence of polluters. However, such secondary factors may also be governed by evolution, if we consider, for instance, the possible mechanisms of group selection. There are factors in an economy that are not in the interest of any one participant but are nevertheless essential for the society at large, such as schools, roads, hospitals, insuring domestic tranquillity, and providing for the common defense-just to mention a few. The necessity for lighthouses is a brilliant example given by Samuelson and Nord Haus. Lighthouses save lives and cargoes, but a lighthouse keeper cannot charge directly for services rendered, for how could he determine who has made use of his beacon? Furthermore, the cost of operating a lighthouse is independent of the number of customers. A beam that warns a hundred ships is no brighter than one that warns a solitary craft. No economy can function without such communal enterprises, and natural selection cannot evolve them. Yet the same problem arose in biological research into the evolution of bee colonies. If evolution can develop a division of labor such as that found in bee colonies, perhaps evolution could bring about economies that create communal values. These problems are analogous, so what might account for such different solutions? The existence of common services in an economy does not exclude the influence of the mechanisms of evolution. At the very least, these mechanisms resemble the principles of group selection. The rules under which an economy operates are created by people, acting with free will. This may be an important factor mitigating the existence of mechanisms of evolution in economics. Biological organisms have no role in the development of the rules under which they must operate. It was Darwin's ingenious idea that the development of species can be explained purely by the mechanism of natural selection. Consequently, concepts like "will" and "rationality" can be banished from evolutionary theory. However, these concepts certainly cannot be banished from the rules of economics. Nevertheless, the goalless march of evolution seems to have created a purposeful human intelligence that creates economic regulations. If a person participates in an economy as if with perfect rationality, whether through reasoning, intuition, or just dumb luck, such behavior would in any case create the appearance of perfectly rational thinking, just as in nature the individuals and species that survive and flourish have behaved as if they had made rational decisions. Some economists, Milton Friedman for example, use this very "as if' phenomenon to explain why in their theories they consider people to be rational beings despite their all too frequent stupidity. Thus, just as undirected evolution has produced the appearance of rationality, so have the purposeful economic rules created by man.

The Invisible Hand

Perhaps the most influential work in economics is An Inquiry into the Nature and Causes of the Wealth of Nations, published in 1776, in which Adam Smith describes the principle of the invisible hand, according to which every individual while working exclusively for his own personal gain, seems to be guided by a beneficent invisible hand to render the best possible service to the commonweal. Here are some frequently cited extracts from Adam Smith's book:

It is not from the benevolence of the butcher, the brewer, or the baker, that we expect our dinner, but from the regard of their own self-interest. We address ourselves, not to their humanity but to their self-love, and never talk to them of our own necessities but of their advantages. (p. 14)

He generally, indeed, neither intends to promote the public interest, nor knows how much he is promoting it. ... He intends only his own gain, and he is in this, and in many other cases, led by an invisible hand to promote an end which was no part of his intention .... By pursuing his own interest he frequently promotes that of the society more effectually than when he really intends to promote it. (p. 423)

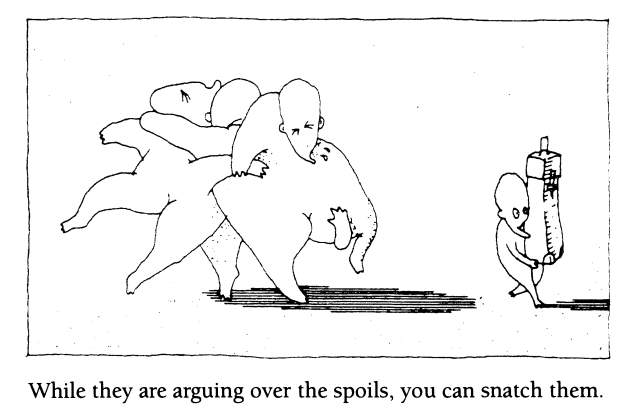

By explaining its rational nature, Adam Smith became a prophet of free competition. Economies certainly existed before the development of the free market, and even then, high levels of eqUilibrium developed, as in the so-called Asian mode of production, which survived almost unaltered for thousands of years. These systems, too, could be the product of evolution, perhaps of a form in which emphasis on group selection was greater. When free competition developed, however, this represented perhaps the appearance of a new "gene" in the economy, shifting evolution's emphasis to that of gene selection. Adam Smith never exactly verified his invisible hand principle. Although we saw in Chapter 7 that competition may promote cooperation, until John von Neumann appeared, nobody knew how Adam Smith's very effective theory could be verified, even in part, by scientific methods. Adam Smith's theory was purely intuitive. The theory proves to be correct only under conditions of perfect market competition, and Smith gave examples from ancient and contemporary history of how well-intentioned government intervention could produce an adverse effect. Von Neumann's theorem and its generalizations to multiperson games in economics have largely supported Adam Smith's intuitive inSights. The principle of rationality, according to which every player seeks to promote his own pure interest and assumes the same of his opponents, may engender prolonged and stable equilibrium. Yet it was game theory itself that indicated the limitations of Adam Smith's theory. In cases of non-zero-sum games, the invisible hand can lead far afield from the common optimum. For instance, in the prisoner's dilemma (and its multiperson version, the problem of the common pasture), the invisible hand leads to mutual defection thus to catastrophe-and this is the only Nash equilibrium point. In such situations, the government may be required somehow to herd the participants in the economy into mutual cooperation. Not only was Adam Smith's book a forerunner of important trends in economic theory, but it also presaged Darwin's theory of evolution, which was developed almost a century later. According to Darwin, the basis of change in nature is the struggle for survival of completely selfish individuals, and it is this struggle that has led to biological diversity on earth, to the development of species. Evolution is the invisible hand that governs this whole process, and its method is natural selection. The theory of Adam Smith, however, applies only to that part of evolution that is represented by the theory of gene selection. If group selection mechanisms, too, are involved in the operation of biological evolution, then these must appear somehow in the economy as well, even in economies of purely free competition.

Theories of Equilibrium

Among the players of the game "economy" are manufacturers and consumers. Every manufacturer has his own set of conditions that determine what he can produce at what cost. Thus the possible pure strategies-the goods that he can produce are available to every manufacturer. Most manufacturers do not apply their entire capacity to produce a Single product: They play a mixed strategy. The outcome a manufacturer can achieve by playing a particular mixed strategy depends on his costs of production and on the price the product can fetch in the marketplace. If the cost and price of every product are known, then the outcome for any mixed strategy can be calculated exactly. The players taking the role of customers also have their agendas. They know how much money they have, and they also know the degree of satisfaction they can achieve by buying a particular commodity at a particular price. Some products can be substituted by other products. Moreover, customers do not spend all their money on a single product: They, too, playa mixed strategy. Naturally, manufacturers are also customers, for they buy raw materials and services, but let us not complicate things too much. let us consider each manufacturer to be two players: one manufacturer and one customer. If all products were available in the marketplace in unlimited quantities and at a fixed price, then we would be able to construct the game table and study it by the usual methods of game theory. In economics, however, the situation is more complex. Customers can buy only as much as manufacturers produce, and prices, far from being fixed, depending on demand and supply. Therefore, the table of the game has to be modified accordingly. If the strategies of all of the players are known, we can tell which products will give rise to a surplus or a shortage. But before we can calculate this, the market will have reacted in two ways. On the one hand, the price of a product in short supply will rise, while the price of surplus goods will fall. On the other hand, as prices change, manufacturers and customers will change their mixed strategies. Manufacturers will attempt to produce more of the higher-priced goods, while customers will find alternatives to purchasing expensive products. We are caught in the same infinite loop in which we pondered, "I think that you think that I think that. ... " Can market equilibrium be established? If so, under what conditions? The Nobel laureate economists Kenneth Arrow and Gerald Debreu found the answer to this question, which is essentially the generalization of von Neumann's theorem to the above game. According to the Arrow-Debreu theorem, there exists a Nash equilibrium of the above game under quite general conditions. (Economists prefer the term weak Pareto optimum for essentially the same concept.) An equilibrium can develop in which no player can increase his profit unilaterally simply by changing his strategy. The Arrow-Debreu theorem, which has become an important method of analysis in modern economic theory, is also called the general theory of equilibrium. At First Sight, this theorem completely vindicates Adam Smith's views. The invisible hand triumphantly creates a stable economic equilibrium acceptable to all, and this is guaranteed by the implacable logic of mathematics. The devil, however, as the saying goes, is in the details. I said above, "under quite general conditions." Although these conditions are really quite general, they are not fully met in any real economy. For example, the following conditions are necessary for the general mathematical validity of the Arrow-Debreu theorem: There can be no effects within the economy whose origins are outside the economy; economic activity has no effect beyond the economy; prices and wages are completely flexible; there are no monopolies. In addition, quite a few further technical conditions are necessary, such as the "law of decreasing profit." We will not discuss the details of these conditions here. If a government wants to create the purest possible free competition, that is, if it wants the greatest possible invisible hand effect, then these conditions must be satisfied, even if by significant restrictions on free competition. Samuelson and Nordhaus conclude:

When the checks and balances of Darwinian perfect competition are absent, when economic activity spills over outside of markets, when incomes are distributed in politically unacceptable ways, when people's demands do not reflect their needs-when any of these conditions arises, then the economy is not led by an invisible hand to an optimum position. Further, when a breakdown occurs, the carefully designed and restrained intervention of government may improve economic performance on this imperfect and interdependent globe.

In the above quotation, Samuelson and Nordhaus use the expression "Darwinian perfect competition." They do not consider the possibility of group selection, although as we have seen, Darwin himself did take it into account. The constraints and compensating factors of "Darwinian perfect competition" do exist in nature, namely, group selection mechanisms, although we do not know exactly what visible part of the invisible hand, mildly influences the economy's activity or perhaps improves its efficiency. In the former socialist countries of Eastern Europe, National Central Planning Boards and the National Offices of Supply and Price-Fixing were all-too-visible hands that fundamentally determined economic processes. It is characteristic of purely socialist economies that the government determines the allocation and use of resources and orders the participants in the economy to follow the state's economic dictates. One may be inclined to look at such command economies as irrational utopias or, in Eastern Europe, as a nightmare recently ended. Yet such economic systems are also the result of rationalism, indeed, rationalism carried to its logical extreme. The system of planned economy is based on an a priori rejection of market equilibrium. A planned economy attempts to optimize the profit of the community by government fiat. Paradoxically, it employs the same mathematical methods as those used to prove the invisible hand's equilibrium. This is not very surprising if we consider that group selection theory and the selfish gene theory both lead to applications of game theory and mixed strategies. We have seen that the Nash equilibrium is far from being optimal for the whole community-often such an equilibrium doesn't develop at all. Let us imagine that an economy has twenty participants whose economic activity consists in playing a one-shot prisoner's dilemma game with each of the other players according to the table below. Naturally, as an economic model, it is completely absurd, but it will serve to show the essence of our argument. they are. Whatever they are, perhaps their imperfect, earthly counterparts in human societies are governments. Once a government is in power, however, it can interfere with economic processes for a variety of reasons.

Planned Economies

An economy can be guided by more than an invisible hand "supplemented" by government intervention. If this were the only role a government played, it would be possible to consider it as a slightly

This table resembles the game studied by Axelrod, but here the temptation to compete is even greater, for now the competitive player who meets a cooperating sucker will win 10 units instead of only 5. In a game where both players cooperate, the two players gain a total of 6 units. If both of them compete, together they will win 2 units. If one of the players cooperates and the other competes, the two players will together gain 10 units. Thus, the total production of the economy will be increased by 6, 2, and 10 units, respectively. Each player plays with 19 other players. Thus 190 games are played all together. If all of the players cooperate all the time, the players will gain

190 X 6 = 1140 units.

That is what application of the golden rule leads to. According to the principle of rationality, the Nash equilibrium will be reached only if everybody competes. In this case, however, the players will gain only

190 X 2 = 380 units.

This is predicted by gene selection theory, and Adam Smith's invisible hand also leads the players to this result. But what happens if 14 players cooperate all the time, while the remaining 6 players always compete. In this case, in 91 of the 190 games both players will cooperate, in 15 games both players will compete, and in 66 cases one of the players will cooperate and the other will compete. Thus, altogether the players will gain

91 X 6 + 15 X 2 + 66 X 10 = 1236 units.

In this prisoner's dilemma, where the temptation to compete is particularly great, the common optimum is not reached by everybody cooperating. The situation is closer to that found in games of chicken: Here again, the categorical imperative, or group selection theory, prescribes a mixed strategy. What can an economist do who has unlimited power in a command economy and who always works for the common good? The best he can do in the interest of the common good is to prescribe a competitive strategy to 6 of the 20 players while compelling the others to cooperate. In this way, the gross national product will be almost ten percent higher than it would be with everybody cooperating, not to mention the case where everybody competes.

The realization of such an optimum in an economy runs into several theoretical and practical roadblocks. One obstacle is that such a system could hardly be maintained for long in the real world unless the government was to take over the distribution of goods; that is, it would require perfect communism. But even then, it would be very difficult to prevent the economic units that are consigned to competition from exchanging their advantageous positions for cash. It is both a theoretical and a practical obstacle that often it is difficult to determine just what needs to be optimized. There was a period in Soviet history when the dishes manufactured by the state-owned porcelain factories began to grow thicker and heavier. Why did this happen? Just as they did in the iron and steel industries, state planners had set porcelain manufacturing goals in tons of output. The practical obstacle is that our omnipotent economist needs to collect and analyze enormous quantities of information that is, he must be omniscient as well. Not even today's computers could carry out such an analysis. We're talking about equations with billions of unknowns, and this would take years even with our fastest computers. But even if it could be analyzed, collecting the necessary data would be impossible, in large part because the interests of most participants in the economy are to keep information secret. This was always the case in the Soviet Union, but even in the United States, the government was able to collect only a small fraction of the data it sought for a 1974-75 large-scale energy model for the country. Experience shows that it is impossible to complete such programs effectively. Furthermore, it is not the only job of the government to regulate the market (that is, to fulfill the conditions of the ArrowDebreu theorem). Government should also promote the common interest-undertake those projects that the majority considers necessary or desirable, from decreasing pollution to the maintenance of lighthouses. It is for this reason that mixed economies have developed.

The Diversity of Mixed Economies

Mixed economies are governed partly by the part pants in the economy, partly by government-directed public institutions. One of the components-the totality of the participants in the economydirects the functioning of the economy by the market's invisible hand. Its operation is described quite precisely by the theory of gene selection. The other component-government-directs the economy in two ways. On the one hand, it can subtly influence the operation of the invisible hand through market regulation and financial incentives, while on the other hand, it can direct the conduct of public affairs in such a way as to provide a positive influence on the marketplace. The government, then, is the component of the economy to which group selection theory may be applied. The relative weights of the two components are quite different in different countries. In the United States gene selection predominates, while in Sweden, for example, group selection has primacy. In every democratic country, free elections determine in part the relative weight to be given to each component. Nevertheless, in long-established democratic countries, radical change rarely occurs. The Swedish political right would be considered left-wing in the United States. In these countries, the proportion of the two components fluctuates within rather narrow limits, although quite large differences can be found among countries. The amount staked in the fight between two male elephant seals is usually very high: The winner will possess a whole harem. No wonder the fight is generally violent, and the loser is usually severely injured. In this case, the selfish gene theory seems to be operational. Yet in the case of ants, group selection theory seems more apt. Sticklebacks are somewhere in the middle. The genes of individual organisms also determine to some extent the degree to which the two principles of evolution are present. The situation is similar in economics: The attitudes, culture, national character, education, and constitution of the labor force determine the proportion of the two components of a mixed economy. The biological parallel is not entirely without foundation. The American biologists Charles Lumsden and E.O. Wilson noticed that our social milieu is composed of elements that can be substituted for one another, just as our biological self is constructed from the blueprint of our genes. For instance, we can choose the clothes we wear, the stories we tell our children, and the strategies we apply in solving problems. It is as if we selected our own genes for skin color, height and physique. Although social attributes are not inherited genetically, nonetheless they are passed on as a kind of cultural heritage, and they can think of as if they fight their own struggle for survival. Lumsden and Wilson called these elements culture genes and quite successfully applied the mathematical methods developed for genetics to them. The equations of evolutionary biology applied to culture genes were able to model a number of cultural characteristics, from the evanescent whims of fashion to our most enduring cultural monuments. Significant differences are to be found between the cultural gene pools of different countries. As a result, evolution can bring about different types of mixed economies. The general laws of economics, however, hold generally. In this, there are no real differences among countries. Likewise, we have good theories about the mechanisms of gene selection, and they can be applied to any species. Different species, however, engage in very different forms of combat, although the aim of every struggle is the same: survival. The individuals of one species may fight to the death to settle a dispute that is resolved in another by nonviolent posing. The behavior is determined by the genetic makeup of the species. The general conditions under which the fight takes place are determined not by gene selection, but rather by the mechanisms of group selection-although we have much less of an idea of how this works. According to our analogy, the counterpart of animal species is the economies of countries. If a country wants to direct its economy to influence the invisible hand (which is necessary, as we have seen), this may require completely different steps in different countries, for a method that proves effective in one country may not work at all in another.

The Logie of Evolution

In analogy with economics, it may be that evolutionary theory does not have to resolve once and for all the debate between the gene selection and group selection hypotheses. Perhaps the two theories simply throw light on two equally valid aspects of the mechanism of evolution. In economics, those systems appear to be favored in which both principles can function simultaneously. It is as if evolution itself were playing a mixed strategy with gene selection and group selection, applying the various proportions of the two to both economies and species. Nature can apply a mixed strategy in two ways. It can create populations of individuals each of whom plays one or another pure strategy, or it can create individuals who realize the appropriate mixture of strategies within themselves, behaving now one way; now another. Experimental evidence points in both directions. Biological evolution most likely uses the latter method to combine the two theories of selection: Both mechanisms affect every species, although their proportions may vary among species. Among the mechanisms by which the natural force we call evolution exerts its influence, the first that we considered was natural selection. We have seen that natural selection may have many forms in nature, such as group selection and gene selection, and it is also possible that there are further, hitherto unknown, forms. Now, we may ask by what mechanisms evolution determines the proportions among the different forms of natural selection. This question is not ripe for systematic investigation in biology, but the example of economics may provide some hints. In an economy, the proportions of the two types of regulating mechanisms can be subtly controlled by democratic systems through regular elections. These elections are ultimately about the economic direction in which a government should move. For all the theoretical problems with this assertion, problems such as the limited rationality of voters (to what extent do irrational forces operate beneath the apparently rational surface of democracy), for economies, democracy has shown itself nevertheless to be the most effective means of evolution thus far. This does not mean that the higher-order mechanisms of evolution in nature are some abstract form of democracy. Most likely they are not. We can say only that democracy realizes some of the unknown mechanisms of evolution successfully, even if unknowingly and unintentionally. After all, democracy is a product of evolution itself. Perhaps it is nothing more than a highly successful cultural gene. Its success is due perhaps to its ability to guarantee social and economic stability, thereby promoting the survival of the selfish cultural gene. Perhaps it has proven effective because of its superficial rationality and deeply hidden irrationality. The reader may take this last remark with a grain or two of salt, though in the third part of the book we shall talk about such topics in discussing human thinking. What ultimate principle governs evolution itself? Perhaps such a final principle is a higher-order, hitherto undiscovered, a form of rationality that mixes the already discovered forms of rationality, namely, the principle of rationality, the principle of stability, the categorical imperative, and perhaps other principles as well. But perhaps this higher-order principle transcends rationality, a principle that exceeds human understanding.

Comments

Post a Comment