1st Bac - Tax Culture

Tax Culture

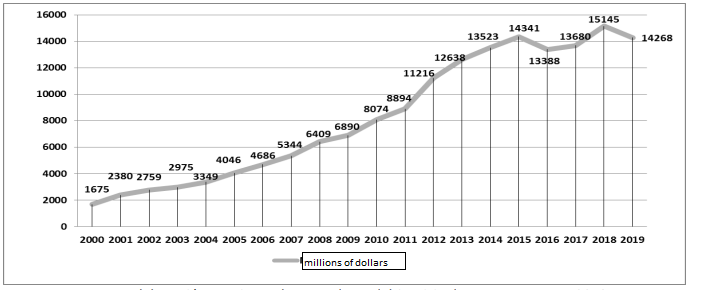

Evolution of gross tax collection (period 2000 to 2019).

The expansionist zeal was financed through arbitrarily applied taxes collected through force and violence.

This exercise was evident during the different types of colonialism, in which the imposition of tribute was a means of oppression. The socially and politically dominant classes were freed from contributing to the public administration, enjoyed privileges and advantages, to the detriment of the underprivileged classes. It took humanity a long time to understand the true meaning of taxation as a means for the citizen to contribute to the maintenance of the State. This new conception of taxation came hand in hand with the republic, democracy, and the then called "Rights of Man". The French Revolution was the milestone that marked this new conception of taxation.

Montesquieu, the French liberal thinker, stated that "The revenues of the State are that part of its property which each citizen gives to keep the rest safe or to enjoy it pleasantly. In fixing them, the needs of the State and those of the citizens must be taken into account".

Since then, it has been understood that the fundamental objective of taxation is to maintain social equilibrium; however, in many periods of history, especially in times of war and occupation, forms of domination of peoples through taxation and confiscation of property have been re-exercised. In modern times, it is understood that taxation must have two sources of creation: - Legality: it must be established by law and not by arbitrary imposition. -

Dignity: The tax must contribute to the dignity of the taxpayer; it must never be used to subjugate, humiliate or deprive him of his rights.

Little by little it is being understood that we must all contribute to the maintenance of the State, giving it a part of what we have and produce so that it can fulfill its mission for the benefit of society as a whole.

The challenge for any State is to implement fair, equitable, clear, and supportive fiscal policies to regulate taxes so that everyone contributes according to their wealth and income. The State needs to receive taxes from taxpayers in order to fulfill its mission and services. All this to fulfill its rights, and to provide guarantees to citizens: security, order, freedom, defense, education, health, roads, production, employment, etc.

Comments

Post a Comment