2Bac. Static games

Content:

Prisoner’s dilemma • Dominant/dominated strategies • Iterated elimination of dominated strategies • Nash equilibrium • Backward induction • Normal and extensive form games • Sub-game perfect equilibrium.

Anticipating rivals’ moves

In strategic analysis, it seems important to be able to figure out what one’s rival is going to do, that is, to anticipate a rival’s moves. How can we do this? Strategists (both professional ones (i.e. managers and consultants) and ‘strategists in the making’ (i.e. students)) often assign probabilities to the different actions a rival might take. But can we do better than this? Game theory tells us we can (most of the time)! Let us use an example to illustrate this.

Prisoner’s dilemma – Advertising wars

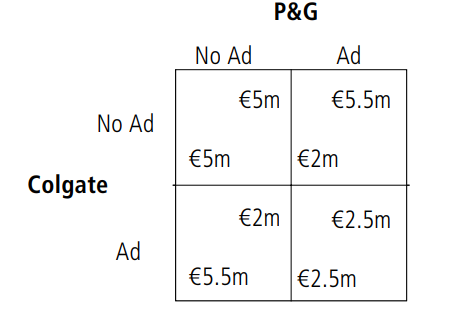

Consider the following situation. P&G and Colgate Palmolive sell competing brands of toothpaste – Crest and Colgate – in a market. The brands share the market equally, that is, both firms have a 50 per cent market share. The overall market for toothpaste is fixed – let’s assume total sales for toothpaste will be €10m per year. Both firms now have the option of launching an advertising campaign for one year at a cost of €2.5m. While advertising does not increase total sales for toothpaste, advertising if the other firm does not advertise would increase market share to 80 per cent. What should both firms do? In fact, can we use the information above to make a prediction of what each of the players is going to do? The first step to take is identifying the players (which is typically a simple but nonetheless important step). In this case, P&G and Colgate Palmolive are the players. The second step is to identify their strategies, that is, what are the choices they have? Here, P&G and Colgate Palmolive decide whether to run an advertising campaign or not. Third, we have to specify the rules of the game. We will go into this in more detail later on, but here the rules are that both players have to decide simultaneously to run or not to run an advertising campaign. Finally, we have to specify the pay-offs for each of the possible outcomes of the game. In this case, both firms not running an ad campaign results in them sharing the market and making sales of €5m. If one of them runs an advertising campaign and the other does not, the first makes sales of €8m (80 per cent of €10m), but has to pay advertising costs of €2.5m, leaving net sales of €5.5m. The other (non-advertising) firm makes sales of €2m. If both firms advertise, their sales will be €5m again (as the market for toothpaste is fixed), but they again incur an advertising cost of €2.5m, resulting in net sales of €2.5m.

We can now represent the game in matrix, or normal form. First, however, a word on convention: The first pay-off (or the leftmost) will be the pay-off of the row player – that is, the player choosing the row (top or bottom), Colgate in this case. The second pay-off (or the pay-off further to the right) will be the column player’s pay-off (i.e. P&G).

Comments

Post a Comment